|

| ||||||||

|

|

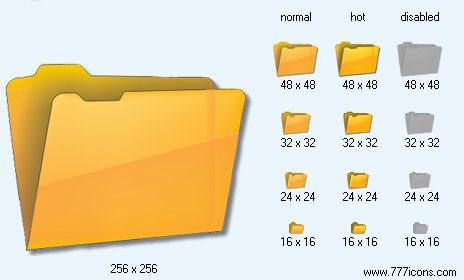

Folder V4 Icon |

|

Image sizes: 256x256, 128x128, 48x48, 32x32, 24x24, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: weather channel icon, 3d folder icon, application icon, black icons from, icon 5

It is one of those few situations when purchased stop would not help the trader with a short position. When the market blows up upwards, the broker can make nothing, while offers from sellers again will not start to arrive. The unique hope to have good skills of management of the capital never to risk in one transaction such big capital which can threaten you ruins.The volatilnyj market, such as the market of futures on S&P, allows you to trade in small amounts and to remove profits which are proportional to average profits on large positions on less it the market. For example, you can buy 10 8&?-it=it=it on 1 087 and sell them on 100 points above with profit $2 500. I remember, when I short time traded in eurodollars, average movement made 10 or 12 points. For large financial institutions quite usually to expose purchase on 12 000 contracts till 93.00 and sale on 7 000 contracts till 94.00. Thus, to get the same profit $2 500, you should conclude the bargain on 100 eurodollar contracts everyone costs one million the US dollars placed on the deposit in Europe. For me habitually to trade in a large way, therefore similar positions did not frighten me. Then in one of days I have realised that I am in a long position on 3 000 contracts in evrodolla -

METAMORPHOSES 137 pax in a position which costs three billion dollars! On it it the market where players prevail large it, purchase or sale of 3 000 contracts did not call any fears. But I risk-exposition would be huge if, for example, it has suddenly lowered interest rates. This risk much more outweighed profit assumed by me. I left that position, having got off with easy scratches have returned to ?&?-Ά?¦it without profit and never any more did not trade in eurodollars.

My discipline and the technical knowledge developed for last years, have made me not only more good trader, but also the expert in the field of execution of orders. To the middle of 1980th years I became the leading broker in a hole of futures on S&P. Clients asked me to rely often on my own opinion at execution of their orders. I have started to receive from clients orders "without a binding to a tape" (DRT-orders). It meant that they wanted, that I bought or sold contracts at sole discretion, instead of according to that occurs in the market.

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|