|

| ||||||||

|

|

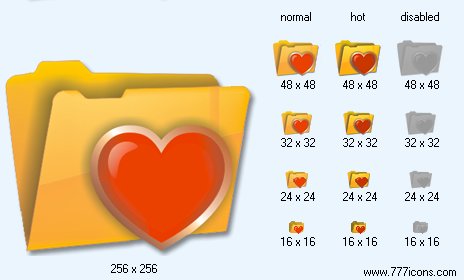

Favorites V4 Icon |

|

Image sizes: 256x256, 128x128, 48x48, 32x32, 24x24, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: favorites icons, piece of paper icon, icon windows, how to change a icon, icon pack xp

The second way it merge to other organisation. All same legal offices select to you firm which is ready to absorb yours. The contract on merge (joining) subscribes, the statement of a transfer of documentation is drawn up, and the re-registration is made. After its carrying out your organisation is deleted by the state from the state register of firms, and you are again free. It is a way occupies 1-1,5 months, costs more expensively, about 30 thousand river, but it is more qualitative, as your organisation for the state ceases to exist.If you have stopped a choice on liquidation through sale, all the same it is necessary to spend all same preparatory actions. Also remember that rest will come only after reception of documents on end of process of liquidation, sale or merge. Until if tax check or check from funds you have got on it and penalties appears suddenly. Also till the moment of reception of an extract from the state registry about liquidation (sale, merge) firms she is obliged to pay taxes.

What way of liquidation to choose, you solve only. Responsibility lies too exclusively on you. Yes in general, all responsibility for a state of affairs in your business, a life you bear only. It is necessary to abuse only itself.

At liquidation through sale or merge and reorganisation always there is a probability that tax inspection can try to declare the transaction insignificant. To formal signs it is possible. If the firm had big debts, errors in the reporting and it was suddenly bought by Ivanov Ivan Ivanovich what for it was necessary to him? For altruists such still to look. The same concerns and the transaction through merge, but here to sap more difficultly as your organisation disappears from the register of firms. The probability of such succession of events is very small, but it is also you should know about it.

Involving legal office for enterprise liquidation, it is desirable not to pay all sum for job at once and to be limited in the advance payment. It is necessary, that the contract with instructions has been concluded that experts make liquidation of your firm, instead of render legal services. Documents pass only under the inventory with drawing up of the transfer certificate. Signatures and round stamps of the parties are obligatory. After end of all procedures to you should give out to a copy of new constituent documents in which the new proprietor, or a copy of the notice on an exception of the organisation of the state registry (will already appear at merge). If official liquidation tax inspection the copy of the notice on liquidation of the organisation and its exception of the state registry stands out is carried out.

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|