|

| ||||||||

|

|

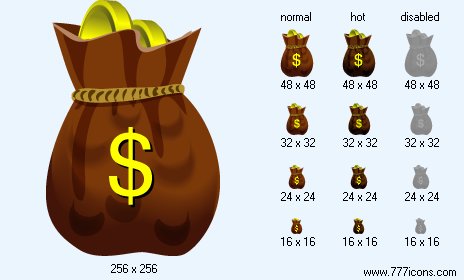

Money Bag V2 Icon |

|

Image sizes: 256x256, 128x128, 48x48, 32x32, 24x24, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: access 2007 icon, white icon for, emo funny icons xanga, military love icons, haseo icon

Transfer on money will appear such that the choice of any alternative will not giveAny advantages, i.e. a1+q1, a2-c2 and l3 will be equal among themselves. A choice

The value standard it will be indifferent for this result, because Transition from one standard to other will change all members equally, and On the size equal to expected norm of increase of value (or Depreciation) the new standard in transfer on the old.

From here those assets, which normal ask price below their price Demand, will be made again. It will be those assets, limiting Which efficiency above (on the basis of their normal ask price), than Norm of percent (at measurement of both sizes in one standard of value, Whatever it was). At the further increase in fund of assets, which Have appeared, having the marginal efficiency at least equal to norm Percent, their marginal efficiency (on already stated clearly enough To the reasons) tends to fall.

Thus, the moment when will be unprofitable to make these will come

Assets if only the norm of percent does not fall simultaneously and in the equal

Degrees. When any more there will be no asset, limiting Which efficiency reaches norms of percent, the further issue Capital assets will cease. We will assume (simply as a hypothesis on The given stage of the proof) that there is any asset (for example, Money), which norm of percent is constant (or falls more slowly with Issue increase, than norm of percent for any other goods). As This situation will be settled?

As a1+q1, a2-c2 and l3 are necessarily equal among themselves and

As, according to a hypothesis, l3 either it is constant, or falls more slowly, than

q1 Or - c2, it follows from this that a1 and a2 should increase.

In other words, the present money price of any goods, except money, has

The tendency to fall in relation to its expected future price. From here follows,

If q1 and c2 continue to fall, there comes the moment when it is unprofitable

To make any of these goods if only it is not expected that costs Productions during some future moment will exceed present costs on Size which will pay expenses on the contents made in the given The moment of a stock till the moment of prospective recovery of price.

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|