|

| ||||||||

|

|

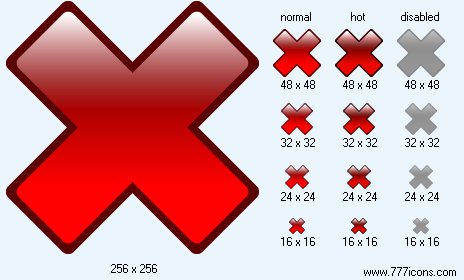

Delete V2 Icon |

|

Image sizes: 256x256, 48x48, 32x32, 24x24, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: icon gif maker, create icons, delete zibri blog icon, icon for software, icon helments

20 it: BLOOD, SWEAT AND SUCCESS TEARS Relaxing with it and a cellular telephone, in a holiday apartment on the bank of lake Geneva.It is difficult to explain to people outside of our small circle as I earn on a life. Somebody on a platform for a golf, having heard that I the trader, wish to learn my opinion rather Intel or IBM, or about any other actions. I explain that I do not trade in separate actions. My speciality — futures on S&P, the contract which is based on an overall cost S&P 500.1la-for at the guy usually become glassy, then he asks, whether market falling was terrible one week ago for me, or whether I have broken a large sum on last lifting.

I explain that has no value, in what direction the market moves. The trader can gain money when the market grows and when falls. We trade both with long, and from the short party. If by this time my interlocutor definitively has not started missing, I continue to explain. It all the same what to conclude a bet with the friend on the winner in the Super-cup. Probably, you think that Dallas moves to a victory, therefore you put to Dallas. But as simply you can put against Dallas to Bronx. The same with futures on S&P: if you think that the market goes on increase, become in a long position, buying contracts; if you think that the market go down, become in a short position, selling them under the current price.

People draw an analogy often between a stock exchange and gamblings. Undoubtedly, these employment risky, and on both arenas are playing for high stakes, and those who, pressing money to a breast, risks the tiny sums. But when you throw bones in Vegase, probability of loss of five points same, as well as for seven. Professionals of gamblings for increase of the chances use various strategy, but from chances not to get to anywhere. In trade you speculate on assumptions of possible behaviour of the market, being based on the analysis of fundamental and technical aspects. You know the factors influencing the market. It can be good news about crisis to Asia or Alan Grinspe-na's prevention that economy too it. And still in the market even the best trader can receive a crushing blow. It occurs suddenly, without the obvious reasons. It can be in a long position when the market sharply falls, and he cannot sell the contracts with profit while the price remains at level lower, than that on which he bought. I in such position was more often, than

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|