|

| ||||||||

|

|

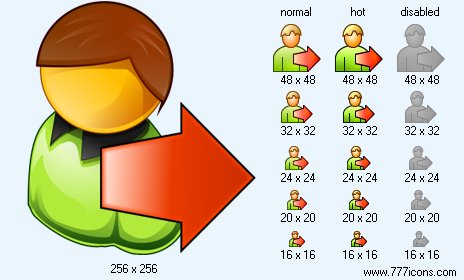

Logout V7 Icon |

|

Image sizes: 256x256, 48x48, 32x32, 24x24, 20x20, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: gif icon maker, tiff icon, how to create a icon, plurk icons, biddy icon

The heretics, including Mandevilja, Maltusa, Gezella and Gobsona whom, followingThe intuition, have preferred, let it is vague and it is partial, to see true, than

To protect the error introduced, the truth, with observance of requests of clearness and

Sequences, on the basis of the simple logic, but from preconditions, not Corresponding to the facts.

CHAPTER 24

Closing remarks about social philosophy in which can result General theory

I

The most significant defects of economic company, in which we We live, are its inability to supply a full employment, and also it Any and unfair distribution of riches and incomes. Communication

Stated above the theory with the first part of a problem it is obvious. But there are also two

The prominent aspect, concerning its second part.

From the end of XIX century significant progress in removal has been reached

Overwork inequality of riches and incomes by means of direct taxes:

Income, additional progressive and the tax from the inheritance, especially in

Great Britain. Many would like to go on this way further away, but them Stop two reasons. Partly they are afraid that is too great

There is a temptation of dexterous evasion, and also that stimulus too will decrease to

To acceptance on itself of risk. With their main image confuses, as I think, Submission that capital growth depends at most promptings to To individual savings also that in the relation it parts of this growth we

We depend on savings of rich people at the expense of their surpluses. Our arguments not

Mention the first of these reasons. But they can essentially change

The relation to the second. We saw that before full employment level achievement

Capital growth at all is not stimulated with weak propensity to consumption, and,

On the contrary, restrains it. Only in the conditions of a full employment the weak

Propensity to consumption promotes capital growth. Moreover, experience

Shows that in present conditions of savings of establishments and redemption funds

More than are sufficient, and the actions directed on redistribution

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|