|

| ||||||||

|

|

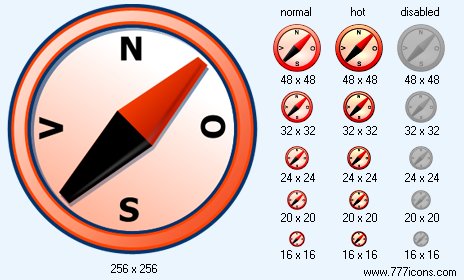

Compass V4 Icon |

|

Image sizes: 256x256, 48x48, 32x32, 24x24, 20x20, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: metal online now icons, free pc icon, option globesurfer usb icon 7.2, new system icons, deathstar icon

In other words, do not invest in what do not understand even if it promises you reception of the free income of 7,75 percent from taxes with prospect of reception of the income of a capital increase in value. The rich daddy would tell:it Before to invest in something, invest time to study it it. It in investments in this market almost 15 years independently are engaged, and my experience in this business for some years is more. Here the financial intelligence whence undertakes. He is born as a result of time investment in the real world. The financial intelligence cannot be result of that you will give your money to the manager of fund, and will pray then that it has well performed the job. You will not develop the financial intelligence, investing thus. As already it was told earlier, many people invest, but and do not become investors. Investments into your financial education can pay off not at once, but in due course will pay off necessarily. Therefore I repeat once again, I do not advise to you to call to your exchange broker and to invest in municipal hypothecary mortgages REIT, because as in all cases with investments, happen good mortgage REIT and bad mortgages REIT. That I urgently recommend, so it to invest in your financial education, especially if you wish to construct a rich ark.I will tell it is more, financial education it an indispensable condition of construction of a rich ark and its deduction afloat after descent to water.

Why the middle class risks, even if plays for certain

The rich daddy has somehow told to me: itFinancially the middle class plays risky. They go on enormous financial risk with the plan of category DC because invest a heap of money in the plan and not enough time it in training to investment. If you wish to become rich, invest at first a lot of time before you will start to invest many moneyit. Therefore do not hurry up to close your savings bill and at first invest any time in more to learn about investments.

Certainly, 7,75 percent are not the highest factor of a recoupment. But, as I have told, it only the example characterising a difference between financially formed and average investor. I used this example only to show, how much is insufficient financial education. Actually, as the professional investor, I prefer to receive a minimum of 40 percent of the net profit from investments and consequently at all I do not spend time for savings.

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|