|

| ||||||||

|

|

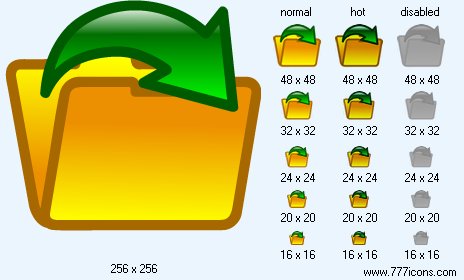

Open File Icon |

|

Image sizes: 256x256, 64x64, 48x48, 40x40, 32x32, 24x24, 20x20, 16x16

File formats: BMP, GIF, PNG, ICO

Tags: free icon file, professional icons, 32 degrees icon x starter paintball, icon advisers inc, call of duty 4 pretige icons

Keeping the prices of long-term debts to overdue and imperfect influence of the priceFloating debts - though here again besides it is not visible the reasons compelling

To similar actions. There, where there are these restrictions, direct character

Communications between norm of percent and quantity of money in appropriate way

It is modified. In Great Britain the tendency to sphere expansion is shown The active control. But, applying the considered theory to any separate To case, it is necessary to consider features of the methods actually used The bodies regulating monetary circulation. If the last conduct operations Only with short-term promissory notes, we should consider, What that influence, which price of short-term promissory notes (the flowing Or assumed in the future) renders on promissory notes more Long terms.

So, possibilities for the bodies regulating monetary circulation, To establish any given complex of interest rates on debts on the various Terms and with a various class of risk are definitely limited. These Restrictions can be summarised in following items:

1. There are restrictions which follow from own practice

The bodies regulating monetary circulation, - to narrow sphere of the operations

Promissory notes of certain type.

2. Can happen, for the reasons considered above that, after

The norm of percent has fallen to known level, the liquidity preference will appear

Actually absolute - in the sense that almost each will prefer to have Cash, instead of the promissory notes bringing so low Percent. In this case the bodies regulating monetary circulation, could At all to lose an effective control over norm of percent. But though this

The limiting case also can acquire the important practical significance in the future,

Till now I do not know any similar example. In effect,

Characteristic for the majority of the bodies regulating monetary circulation,

Unwillingness safely to conduct operations with long-term promissory notes Has kept few possibilities for check of a similar situation. Besides, if It also has arisen, it would mean that governmental bodies could At banking system means to borrow money in the unlimited Scale on nominal norm of percent.

Copyright © 2006-2022 Aha-Soft. All rights reserved.

|